Escape Foreclosure: Your Essential Guide to Successful Short Sales

Resources and Support for Homeowners Considering a Short Sale

Understanding the Short Sale Process

A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. The process involves the lender agreeing to accept a discounted payoff to release the lien on the property. This option is typically pursued when the homeowner is facing financial hardship and is unable to continue making mortgage payments.

During a short sale, the homeowner must work closely with their lender to negotiate the terms of the sale. This can be a complex and time-consuming process, as it involves submitting detailed financial information, hardship letters, and various documents required by the lender.

It is essential to seek the guidance of a qualified real estate agent who specializes in short sales to help navigate this intricate process effectively. If you are considering a short sale, Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty for expert assistance in managing your short sale and securing the best outcome for your property.

Determining Eligibility for a Short Sale

Determining eligibility for a short sale involves assessing your financial situation and demonstrating a valid hardship that hinders your ability to continue making mortgage payments. Lenders typically require borrowers to be in a distressed financial state, owing more on the home than its current market value. Additionally, proof of financial hardship, such as loss of income, job loss, divorce, or medical emergency, is crucial in proving your need for a short sale.

Furthermore, evaluating your financial standing and exploring all possible alternatives to foreclosure is essential before pursuing a short sale. It is advisable to consult with a qualified real estate agent or financial advisor to review your options and determine if a short sale is the best solution for your specific circumstances.

By seeking professional guidance and thoroughly assessing your financial situation, you can make an informed decision about whether a short sale is a viable choice for you. Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty, for expert advice and assistance in navigating the short sale process.

Finding a Qualified Real Estate Agent

If you are considering a short sale of your home, finding a qualified real estate agent is crucial. Look for an agent who has experience with short sales, understands the complexities of the process, and has a track record of successful transactions. A knowledgeable real estate agent can guide you through the entire short sale process, from determining eligibility to negotiating with lenders on your behalf.

When searching for a real estate agent to assist with your short sale, consider interviewing multiple agents to find the right fit for your specific needs. Ask about their experience with short sales, inquire about their success rate in closing short sale transactions, and discuss their approach to communication and client support.

Remember, having a skilled and experienced agent by your side can make a significant difference in the success of your short sale. Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty. He is an experienced real estate agent who can help you navigate the complexities of a short sale and sell your home.

Gathering Necessary Documentation

To successfully navigate a short sale process, gathering the necessary documentation is crucial. Lenders require specific paperwork to assess the homeowner's financial situation and determine eligibility for a short sale. Common documents that may be requested include bank statements, tax returns, pay stubs, hardship letter, and a listing agreement with a real estate agent.

It is essential to start compiling these documents early in the process to avoid delays. Reach out to your lender or real estate agent for a detailed list of required paperwork and ensure that you provide accurate and complete information.

By being proactive and organized in gathering the necessary documentation, you can streamline the short sale process and increase the chances of a successful transaction. Remember, for expert guidance and support throughout this journey, don't hesitate to call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty.

Exploring Alternatives to a Short Sale

Considering alternatives to a short sale can be a prudent approach for homeowners facing financial difficulties. One option to explore is loan modification, where the terms of the existing mortgage are adjusted to make monthly payments more manageable. This process typically involves negotiating with the lender to potentially lower interest rates, extend the loan term, or forgive a portion of the principal balance.

Another alternative to consider is a deed in lieu of foreclosure, where the homeowner voluntarily transfers ownership of the property to the lender to satisfy the mortgage debt. This option can help homeowners avoid the lengthy foreclosure process and may have less of a negative impact on their credit score. However, it is essential to weigh the pros and cons of each alternative carefully before making a decision.

For expert guidance on exploring alternatives to a short sale and determining the best course of action for your situation, call Rick Kendrick at 561-508-8453 with Your Home Sold Guaranteed Realty. With his wealth of experience in real estate, Rick can provide valuable insights and assistance in navigating the complexities of these options. Don't hesitate to reach out for expert advice and support.

Navigating the Negotiation Process with Lenders

When navigating the negotiation process with lenders during a short sale, it is crucial to maintain open communication and transparency. Be prepared to provide all necessary financial documents promptly and respond promptly to any requests from the lender. Demonstrating a willingness to cooperate and work towards a mutually beneficial solution can help streamline the negotiation process and increase the likelihood of a successful outcome.

In addition to communication, persistence is key when negotiating with lenders. Be prepared for potential delays and setbacks, but remain steadfast in your goal of reaching a favorable agreement.

Consider seeking the guidance of a qualified real estate agent who has experience in short sales. Their expertise can be invaluable in navigating the negotiation process and advocating on your behalf to achieve the best possible outcome. Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty, to get the assistance you need in navigating this challenging process.

• Maintain open communication and transparency with lenders

• Provide all necessary financial documents promptly

• Respond promptly to any requests from the lender

• Demonstrate a willingness to cooperate and work towards a mutually beneficial solution

• Be persistent in negotiations with lenders

• Be prepared for potential delays and setbacks

• Seek guidance from a qualified real estate agent experienced in short sales

• Advocate on your behalf to achieve the best possible outcome

For expert assistance in navigating the negotiation process with lenders during a short sale, contact Rick Kendrick at 561-508-8453. With Your Home Sold Guaranteed Realty, you can get the help you need to successfully navigate this challenging process.

Understanding Tax Implications of a Short Sale

When undergoing a short sale, it is crucial to be aware of the potential tax implications that may arise. In a short sale scenario, the forgiven debt from the difference between the outstanding mortgage balance and the sale price of the property may be considered as taxable income by the IRS. It is advisable to consult with a tax professional or accountant to fully understand how these tax implications might affect your financial situation.

Additionally, certain exemptions or exclusions may apply to alleviate the tax burden resulting from a short sale. For example, the Mortgage Forgiveness Debt Relief Act may provide relief by excluding a certain amount of forgiven debt from being taxed.

Understanding these nuances and seeking appropriate advice can help you navigate the tax implications of a short sale more effectively. Remember, for personalized assistance and expert guidance on navigating a short sale, don't hesitate to call Rick Kendrick, a seasoned real estate agent at Your Home Sold Guaranteed Realty, at 561-508-8453.

Seeking Legal Advice and Guidance

Legal advice and guidance play a crucial role in the short sale process. An experienced real estate attorney can provide valuable insights into the legal implications of a short sale, ensuring that the homeowner is well-informed and protected throughout the transaction.

From reviewing contracts to negotiating with lenders, legal professionals can offer expert guidance that is tailored to the individual circumstances of the homeowner. Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty for expert advice and legal assistance tailored to your specific situation.

Navigating the complex legal aspects of a short sale can be overwhelming for homeowners. Seeking the counsel of a real estate attorney who specializes in short sales can help alleviate stress and streamline the process. From understanding the legal requirements to ensuring all documentation is in order, a legal professional can provide peace of mind during what can be a challenging time. Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty today to get started on the path towards a successful short sale.

Exploring Government Programs and Assistance

For homeowners facing financial hardship and considering a short sale, exploring government programs and assistance can be beneficial. These programs can provide various forms of support, such as loan modifications, refinancing options, or even financial incentives for completing a short sale. By researching and understanding the available government programs, homeowners may find valuable resources to facilitate their short sale process and mitigate the impact on their financial well-being.

Additionally, government assistance programs can offer guidance and resources to navigate the complexities of a short sale. Seeking out these programs can provide homeowners with access to important information, counseling services, and potentially even financial relief. By taking advantage of the support available from government initiatives, homeowners can better position themselves to successfully navigate a short sale and move towards a more stable financial future.

Call Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty for expert guidance and assistance in navigating a short sale. With his experience and knowledge, Rick can provide valuable support throughout the process and help you sell your home efficiently. Don't hesitate to reach out for professional assistance with your short sale journey.

Preparing for Life After a Short Sale

After going through the process of a short sale, it's essential to prepare for life post-sale. Emotionally, it can be challenging to let go of a property that held significant memories, but it's crucial to focus on the fresh start that lies ahead. Start by setting realistic financial goals and creating a budget that aligns with your new circumstances.

Additionally, consider reaching out to a financial advisor to help you plan for the future and make informed decisions about your finances moving forward. Remember, the end of this chapter is also the beginning of a new one, full of possibilities and opportunities.

As you transition into post-short sale life, take the time to reassess your housing needs and explore your options. Whether you decide to rent, buy a smaller home, or pursue other alternatives, it's vital to make a well-informed decision that suits your current situation.

Remember, seeking professional guidance can make this process smoother and more manageable. Reach out to an experienced real estate agent like Rick Kendrick, 561-508-8453, with Your Home Sold Guaranteed Realty, who can provide valuable insights and assistance tailored to your specific needs. Making informed decisions now will lay the foundation for a brighter future ahead.

What is a short sale?

A short sale is when a homeowner sells their property for less than the amount owed on the mortgage with the approval of the lender.

How do I know if I am eligible for a short sale?

Typically, eligibility for a short sale is determined by financial hardship, such as job loss, divorce, medical expenses, or other extenuating circumstances that make it difficult to pay the mortgage.

Do I need a real estate agent for a short sale?

It is highly recommended to work with a qualified real estate agent who has experience with short sales, as they can help navigate the process and negotiate with lenders on your behalf.

What documentation do I need for a short sale?

You will need to gather documents such as pay stubs, tax returns, bank statements, hardship letter, and a financial worksheet to provide to your lender during the short sale process.

Are there alternatives to a short sale?

Yes, alternatives to a short sale include loan modification, forbearance, deed in lieu of foreclosure, or selling the property through a traditional sale.

How do I navigate the negotiation process with lenders during a short sale?

Your real estate agent can help negotiate with your lender to reach a mutually agreeable solution, such as accepting a lower sale price to avoid foreclosure.

What are the tax implications of a short sale?

The IRS may consider forgiven debt from a short sale as taxable income, so it is important to consult with a tax professional to understand the implications for your specific situation.

Should I seek legal advice before proceeding with a short sale?

It is recommended to seek legal advice to ensure you understand your rights and responsibilities throughout the short sale process.

Are there government programs or assistance available for short sales?

There are government programs, such as the Home Affordable Foreclosure Alternatives (HAFA) program, that provide assistance for short sales. It is worth exploring these options with your lender.

How can I prepare for life after a short sale?

It is important to have a plan in place for finding alternative housing, rebuilding credit, and moving forward financially after a short sale. Consider seeking financial counseling or advice to help you plan for the future.

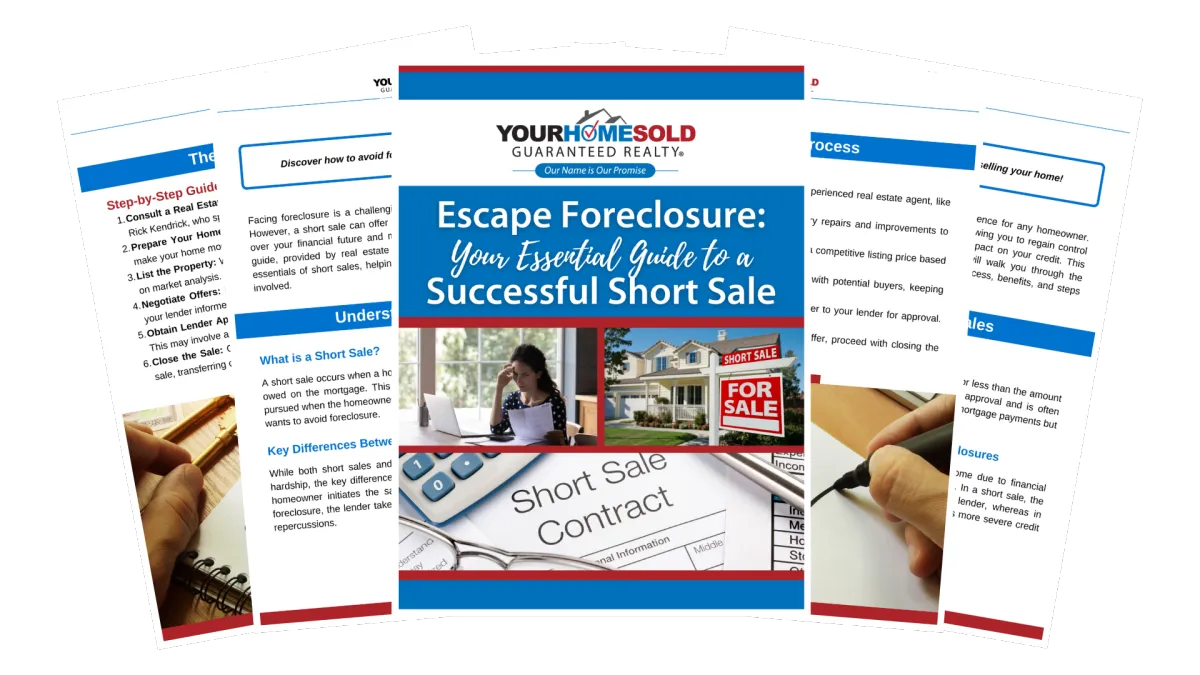

We’ve Created A Beginner-Friendly Guide To Help Your on Your Path to Financial Recovery

Unlock the secrets to navigating financial distress with "Escape Foreclosure: Your Essential Guide to Successful Short Sales." This comprehensive guide empowers homeowners with the knowledge and strategies needed to navigate the complexities of short sales effectively. Whether you're seeking to minimize credit impact, regain control over your financial future, or explore options for debt forgiveness, this guide provides step-by-step instructions and expert insights to help you successfully navigate the short sale process. Don't let foreclosure define your financial future—take charge with the essential tools and guidance offered in this indispensable resource.

2022 All Rights Reserved.